Insurance is a critical component of financial planning. It provides protection against financial 2023loss in case of unexpected events such as accidents, illnesses, natural disasters, and death. Adequate insurance coverage is essential for safeguarding your finances and protecting your family’s future. In this blog, we will discuss the importance of having adequate insurance coverage.

What is Insurance?

Insurance is a contract between an insurer and an individual or organization. The insurer agrees to pay the policyholder a sum of money or provide a service in the event of a specified loss or damage. In exchange, the policyholder pays a premium to the insurer. The purpose of insurance is to protect individuals and organizations from financial losses due to unexpected events.

Types of Insurance

There are various types of insurance that you can purchase, depending on your needs. Some of the most common types of insurance include:

Life Insurance: Life insurance provides financial protection to your family in case of your untimely death. It ensures that your loved ones can maintain their standard of living and pay for expenses such as mortgages, college tuition, and other bills.

Health Insurance: Health insurance covers the costs of medical expenses, including doctor visits, hospital stays, and prescription drugs. It provides financial protection against the high cost of healthcare.

Auto Insurance: Auto insurance covers the cost of repairs or replacement of your vehicle in case of an accident. It also provides liability protection in case you are at fault in an accident.

Homeowners Insurance: Homeowners insurance covers damage to your home and its contents due to events such as fire, theft, and natural disasters.

Disability Insurance: Disability insurance provides financial protection in case you are unable to work due to an injury or illness. It pays a portion of your salary or income while you are unable to work.

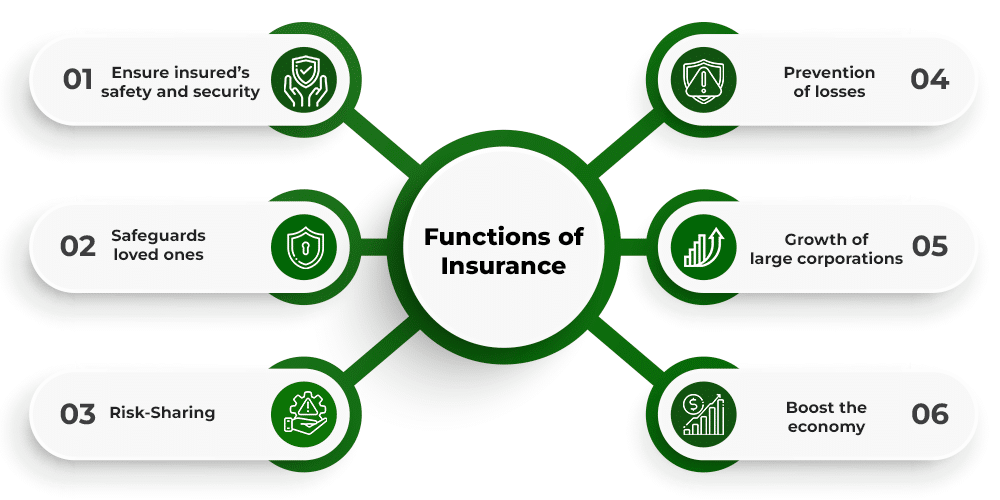

Why is Adequate Insurance Coverage Important?

Adequate insurance coverage is essential for several reasons. Let’s discuss some of the most important reasons why you need adequate insurance coverage.

Protection Against Financial Loss

The primary purpose of insurance is to protect you from financial losses due to unexpected events. For example, if you have adequate life insurance coverage, your family will be financially protected in case of your untimely death. They will receive a lump sum amount that can be used to pay for expenses such as mortgages, college tuition, and other bills.

Similarly, if you have health insurance coverage, you will be protected from the high cost of healthcare. If you get into a car accident, auto insurance will cover the cost of repairs or replacement of your vehicle. Homeowners insurance will cover damage to your home and its contents due to events such as fire, theft, and natural disasters.

Without adequate insurance coverage, you could be financially devastated by unexpected events. For example, if you don’t have health insurance and you get diagnosed with a serious illness, you could be faced with significant medical bills that could bankrupt you.

Peace of Mind

Insurance provides peace of mind. Knowing that you are protected in case of unexpected events can help reduce your stress levels and give you a sense of security. For example, if you have adequate life insurance coverage, you can rest assured that your family will be taken care of in case of your untimely death.

Similarly, if you have disability insurance, you can rest assured that you will have a source of income in case you are unable to work due to an injury or illness. This can help reduce your stress levels and allow you to focus on your recovery.

Compliance with Legal Requirements

In some cases, insurance coverage is required by law. For example, if you own a car, you are required to have auto insurance. If you have employees, you are required to have workers’ compensation insurance.

Failing to comply with legal requirements could result in fines or otherlegal penalties. Therefore, having adequate insurance coverage not only protects you financially but also helps you comply with legal requirements.

Protection of Assets

Insurance can also protect your assets. For example, if you own a home, homeowners insurance will protect your investment in case of damage or loss. If you own a business, commercial property insurance will protect your business property and assets.

Without adequate insurance coverage, you could be at risk of losing your assets due to unexpected events. For example, if you don’t have homeowners insurance and your home is damaged by a natural disaster, you could lose your investment in the property.

Access to Better Healthcare

Having health insurance coverage can provide you with access to better healthcare. With health insurance, you can visit doctors and hospitals without worrying about the high cost of medical bills. This can help you maintain your health and prevent serious illnesses from developing.

Without health insurance coverage, you may not be able to afford the high cost of healthcare. This could result in delayed treatment, which could lead to more serious health problems in the future.

Protection of Loved Ones

Adequate insurance coverage can also protect your loved ones. For example, life insurance coverage can provide financial protection to your family in case of your untimely death. Disability insurance can provide income protection in case you are unable to work due to an injury or illness.

Without adequate insurance coverage, your loved ones could be left with financial burdens in case of unexpected events. This could add to their stress and grief during an already difficult time.

Prevention of Bankruptcy

Insurance can also help prevent bankruptcy. Unexpected events such as accidents, illnesses, and natural disasters can result in significant financial losses. Without insurance coverage, these losses could be catastrophic and could lead to bankruptcy.

Having adequate insurance coverage can protect you from financial losses due to unexpected events. This can help you avoid bankruptcy and maintain your financial stability.

Tips for Choosing Adequate Insurance Coverage

When it comes to choosing adequate insurance coverage, there are a few tips that can help you make the right decision. Here are some tips to keep in mind:

Assess Your Risks: The first step in choosing adequate insurance coverage is to assess your risks. What are the potential risks that you face? For example, if you own a home, your risks might include fire, theft, and natural disasters. If you own a car, your risks might include accidents and theft. Understanding your risks will help you choose the right type and amount of insurance coverage.

Research: Once you have identified your risks, it’s time to research your insurance options. There are many different types of insurance coverage available, and it’s important to understand the pros and cons of each. Research different insurance providers and compare their policies, prices, and coverage limits.

Review Your Coverage Regularly: Your insurance needs may change over time, so it’s important to review your insurance coverage regularly. For example, if you have a child or buy a new car, you may need to update your insurance coverage to reflect these changes.

Consider Your Budget: While it’s important to have adequate insurance coverage, you also need to consider your budget. Make sure that you choose insurance coverage that you can afford, but that also provides enough protection for your needs.

Work with a Professional: If you’re unsure about which insurance coverage to choose, consider working with a professional. An insurance agent or broker can help you assess your risks, understand your options, and choose the right insurance coverage for your needs.

Common Types of Insurance Coverage

Now that we’ve talked about the importance of adequate insurance coverage and how to choose the right coverage for your needs, let’s take a look at some common types of insurance coverage that you may need.

Auto Insurance

Auto insurance is a type of insurance coverage that protects you financially in case of accidents, theft, or damage to your vehicle. It typically includes liability coverage, which covers damages or injuries you cause to other people or property, and collision coverage, which covers damages to your own vehicle.

Homeowners Insurance

Homeowners insurance is a type of insurance coverage that protects your home and its contents against damage or loss. It typically includes coverage for your home’s structure, personal belongings, and liability protection in case someone is injured on your property.

Life Insurance

Life insurance is a type of insurance coverage that provides financial protection to your loved ones in case of your untimely death. It typically includes a death benefit, which is paid to your beneficiaries upon your death.

Health Insurance

Health insurance is a type of insurance coverage that provides financial protection for healthcare expenses. It typically includes coverage for doctor visits, hospital stays, and prescription medications.

Disability Insurance

Disability insurance is a type of insurance coverage that provides income protection in case you are unable to work due to an injury or illness. It typically includes coverage for lost income, medical expenses, and rehabilitation.

Business Insurance

Business insurance is a type of insurance coverage that protects your business against financial losses due to unexpected events. It typically includes coverage for property damage, liability protection, and business interruption insurance.

Umbrella Insurance

Umbrella insurance is a type of insurance coverage that provides additional liability protection beyond the limits of your other insurance policies. It can help protect you from lawsuits and other legal claims.

Conclusion

Adequate insurance coverage is essential for protecting your finances and securing your future. It provides protection against financial losses due to unexpected events and gives you peace of mind. Insurance can also help you comply with legal requirements, protect your assets, provide access to better healthcare, protect your loved ones, and prevent bankruptcy.

When purchasing insurance coverage, it’s important to consider your individual needs and risks. You should also review your insurance coverage regularly to ensure that it remains adequate and up-to-date.

In summary, having adequate insurance coverage is not just a smart financial decision, it’s a necessary one. By protecting yourself and your loved ones from financial losses due to unexpected events, you can secure your future and maintain your financial stability.

For car insurance click here

For progressive insurance click here